Cargo Vessel Baltic Wind Runs Aground in Isefjord, No Pollution Reported

The cargo vessel Baltic Wind ran aground in Denmark’s Isefjord after leaving the navigation channel. No injuries or pollution were reported, and salvage planning is underway.

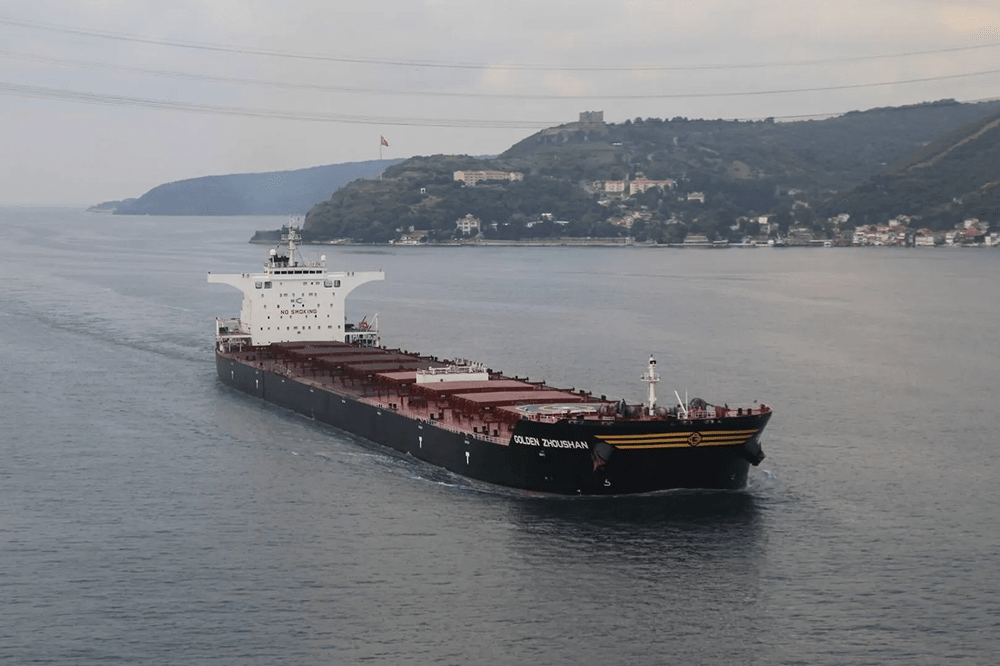

In a seismic shake-up of the maritime industry, Golden Ocean has been absorbed into CMB.TECH, forming one of the world’s largest diversified shipping groups under a single publicly listed entity.

Golden Ocean shareholders approved the stock-for-stock merger at a special general meeting on 19 August, representing 92.7% of shares present, with the merger officially closed on 20 August. In the transaction, each Golden Ocean share was exchanged for 0.95 shares of CMB.TECH, totaling 95,952,934 newly issued shares. Golden Ocean was subsequently delisted from Nasdaq and Euronext Oslo, while CMB.TECH began trading on NYSE, Euronext Brussels, and added a secondary listing on Euronext Oslo, complete with share registration in Norway’s VPS system.

The newly enlarged group now controls a fleet of approximately 250 vessels, spanning drybulk carriers, crude oil tankers, container ships, chemical tankers, offshore wind vessels, and port support craft. The combined fleet carries an estimated book value of USD 11.1 billion, with an impressively young average vessel age of 6.1 years.

This enhanced scale comes with strategic advantages: over 80 vessels are now hydrogen- or ammonia-ready, positioning the group at the forefront of the energy transition. A contract backlog of around USD 3 billion underpins future revenue stability, while a solid liquidity buffer—exceeding USD 400 million including cash and undrawn credit facilities—provides the flexibility to pursue growth and decarbonization initiatives.

CEO Alexander Saverys framed the merger as a historic pivot: in under two years, CMB.TECH has transformed from a niche tanker player into a "future-proof maritime group" backed by listings in key financial markets and a diversified asset base across trade, energy, and green sectors.